If you plan to incorporate a product into its product range, a BeP analysis helps you establish if the expected sales volume is over or under the BeP. Using the BeP, you can also predict how much of a decline in revenue the company can take without going into the red. Should you observe the development of the BeP over the course of a long period, you can identify if the company is moving closer to it. Discontinue production or parts thereof.The following are possible practical solutions: If this happens, the company must act immediately in order to guarantee its survival. It is a warning sign if the minimum revenue or unit sales volume required for the BeP isn’t achieved. The BeP is especially an important indicator for emerging companies.

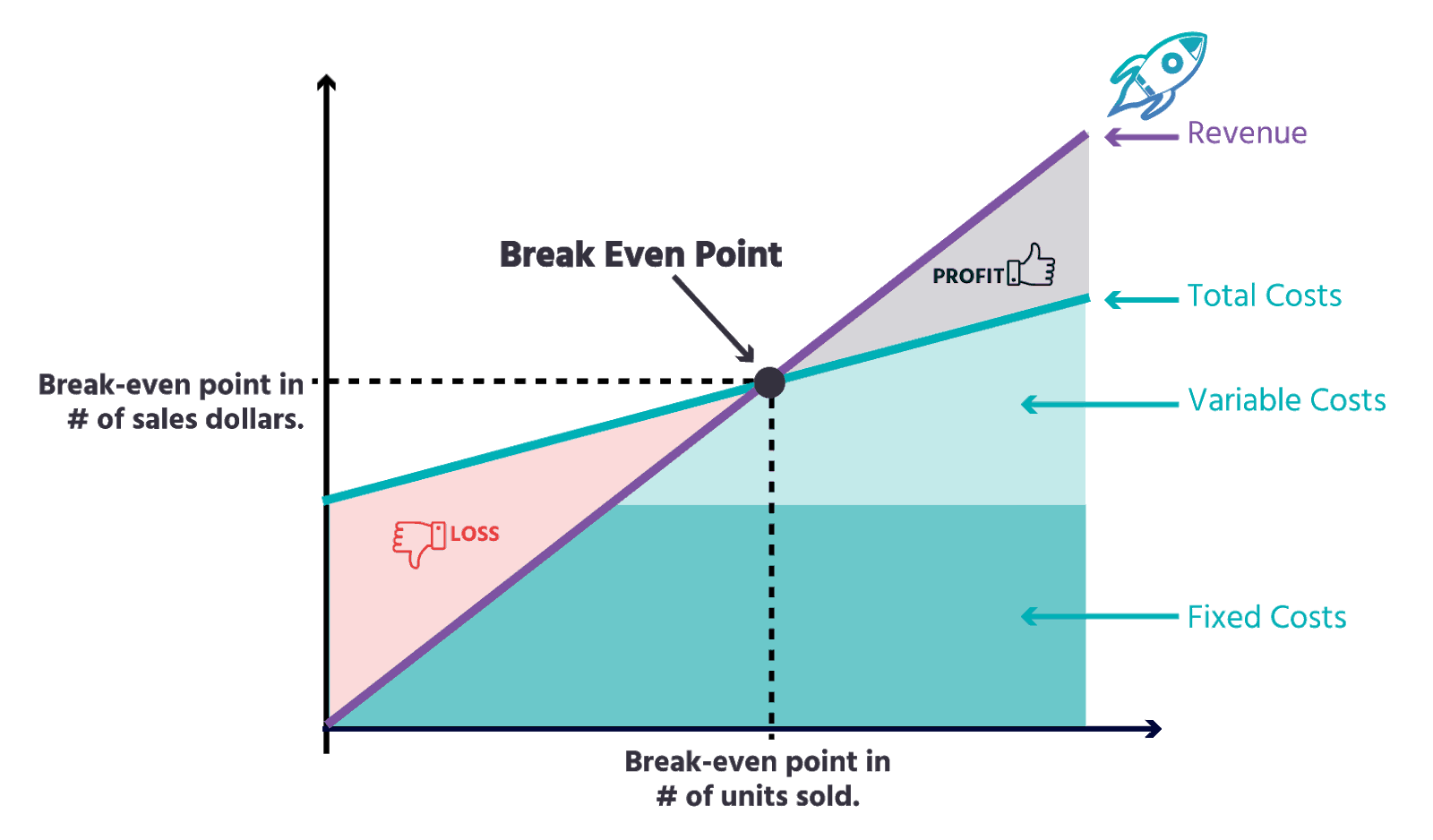

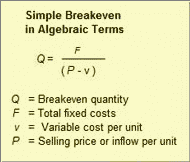

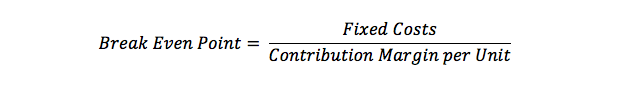

The sum of the fixed and variable costs is the total cost. This is why the variable costs per unit is also called the absolute minimum price. A product’s sale price should at least be as high as the variable costs per unit, otherwise the company cannot stay in the market for long. If you divide a product’s total variable costs by the produced or sold item volume, the result is the variable costs per unit. That can be the case, for example, when you receive volume discounts due to larger purchase volumes. Variable costs can also be degressive, meaning that they increase less sharply than the turnover. They progressively increase, for example, if the maintenance costs for machines sharply increase due to increased production. Should the variable costs increase at a faster rate, then they are referred to as progressive variable costs. If the variable costs increase at the same rate as the production or sales volume, they are referred to as proportional variable costs. As a result, variable costs fluctuate and are performance related. The amount of variable costs is dependent on the volume that is produced and/or sold. The BeP for several products or for an entire company will be specified, in contrast, as the amount of turnover that must be earned in total (multi-product analysis).Ĭolloquially, BeP also refers to the time at which a company breaks even. If you want to determine the BeP for a single product, it will be specified as a quantity of items (single-product analysis). At the break-even point, the company makes neither a profit nor a loss. The BeP threshold separates the loss zone from the profit zone. If costs and turnover are at the same level, the company has reached the break-even point threshold. Should turnover increase over time, the company will move closer to the profit zone. This means that the company is initially situated in the loss zone.

During the first few years, costs are often higher than turnover. And sufficiently high turnover is in most cases not generated right after the company is founded. But this is only achieved when revenue is higher than costs.

#Break even point formula example professional#

Every business professional would like to eventually generate profit.

0 kommentar(er)

0 kommentar(er)